In the Fall of 2022, I worked hands-on with four other students to maximize Citibank’s customer experience with the mortgage and home-buying service, Home Captain.

Citibank asked my peers and I to form potential solutions to maximize the number of customers using and benefiting from Home Captain. See below for our creative process, final suggested solutions, accompanying slide deck, and executive summary

OVERVIEW OF Citibank-Home Captain SOlutions

-

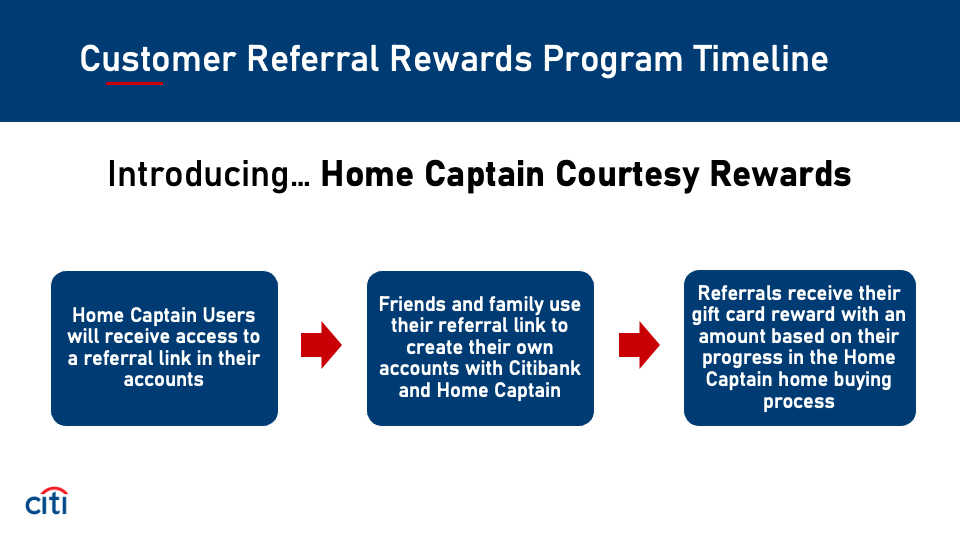

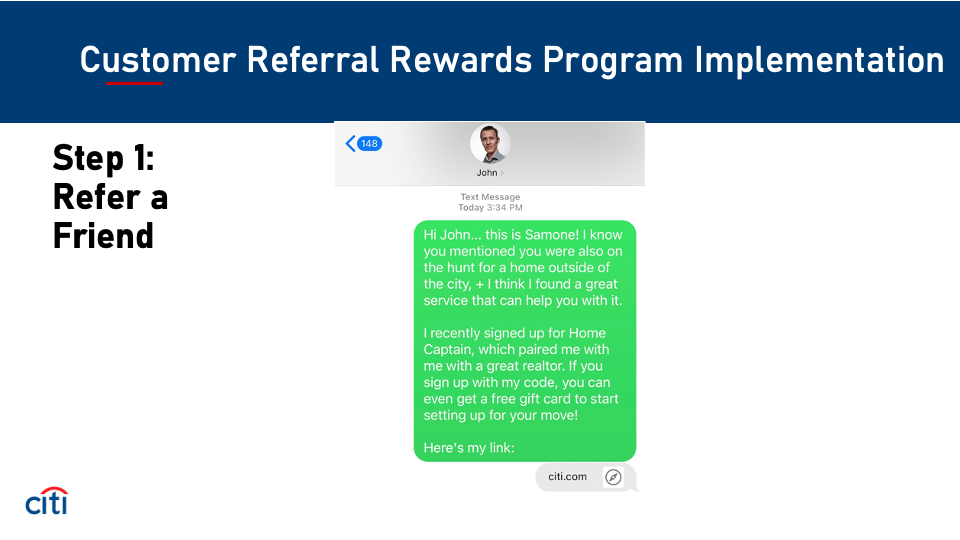

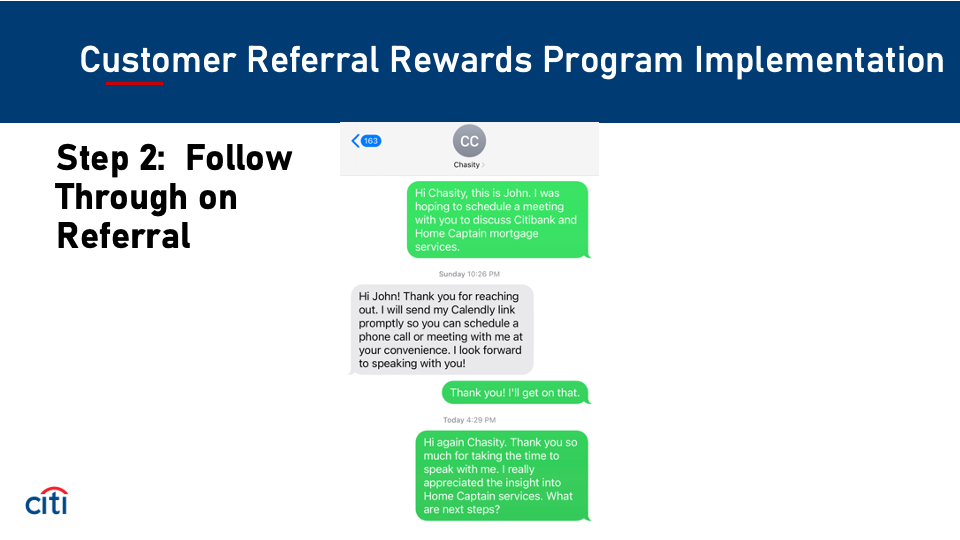

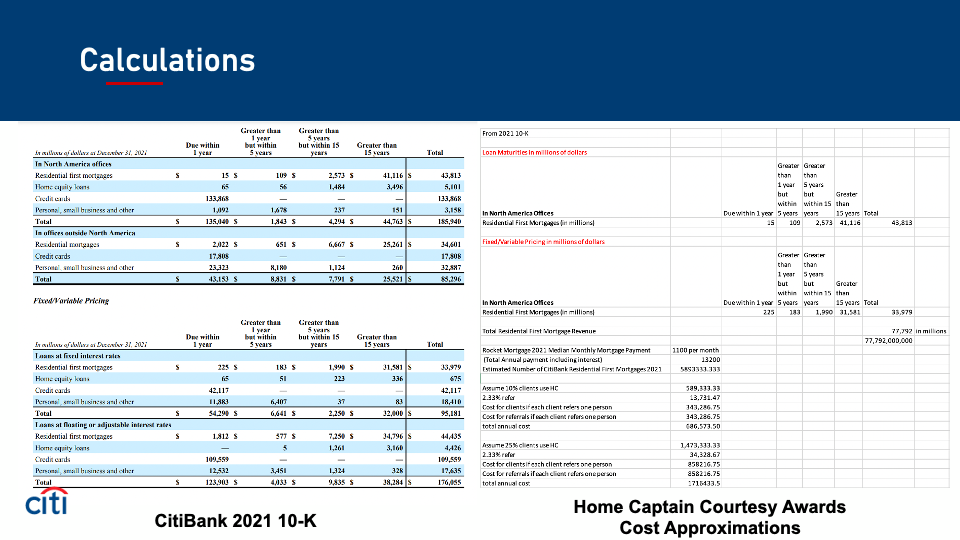

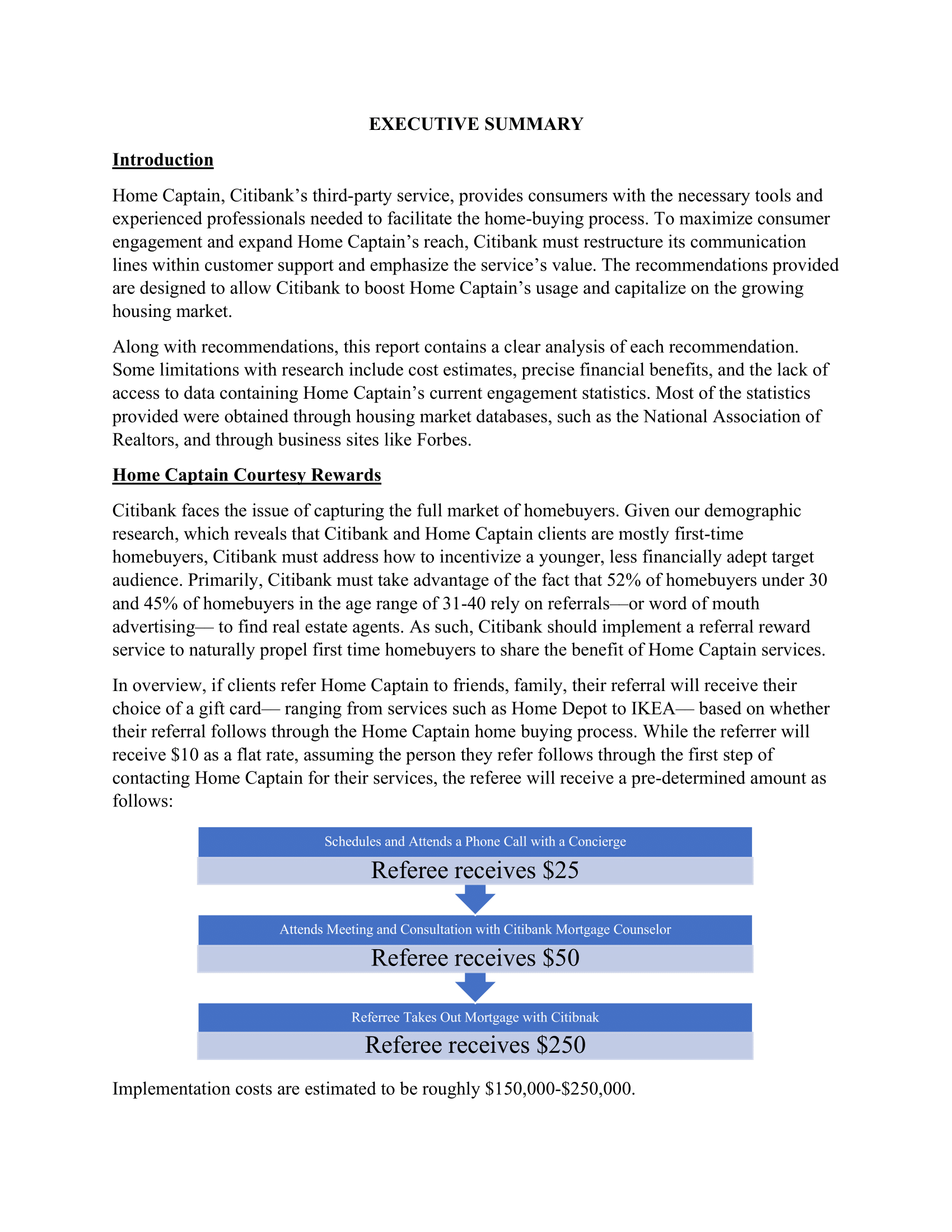

We suggest Citibank implement Home Captain Courtesy Rewards for customers who refer Home Captain to friends

• Users of Home Captain will receive access to a referral link in their accounts they can send to any friends or family, for which they will receive a gift card reward.

• Friends and family can then use the link to create their own accounts and receive various rewards in the form of gift cards depending on their follow-through in the mortgage buying process.

-

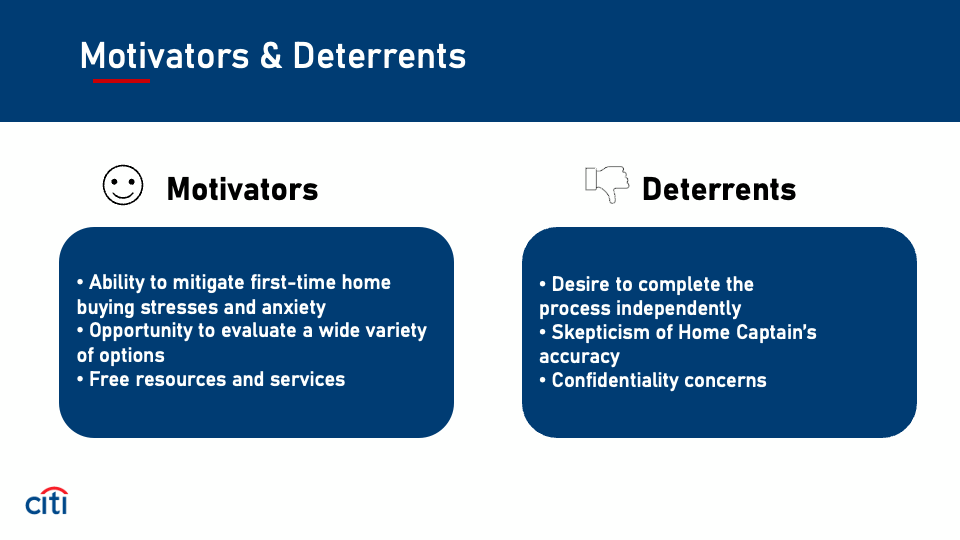

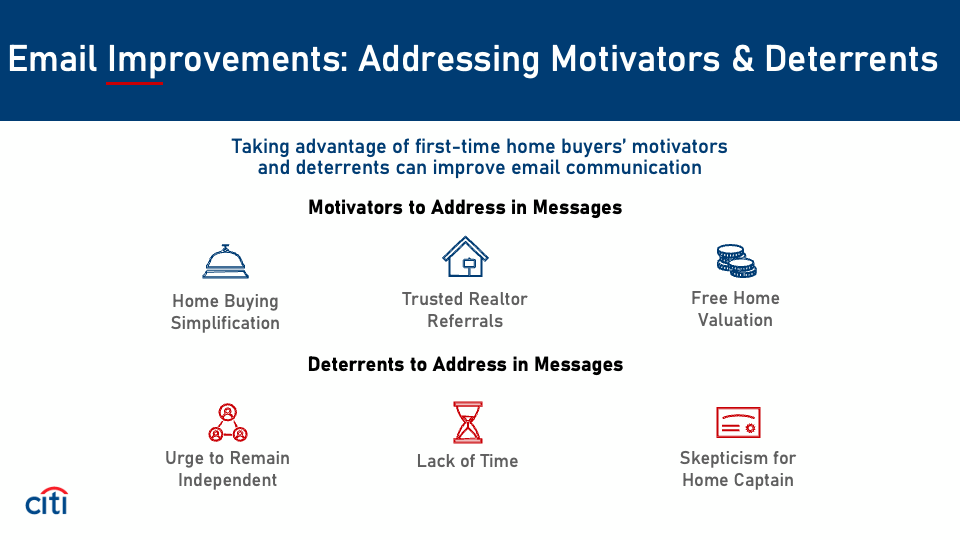

Citibank should take into account customer motivators and deterrents to script all emails:

The main motivators:

• Simplification of the home buying process through concierge

• Trusted realtor referrals

• Free home valuation and market analysis

The main deterrents:

• Current mortgage rates are disincentivizing buyers

• Lack of time to dedicate to home buying due to family/career time commitments

• Substitutes for online home-buying services exist

-

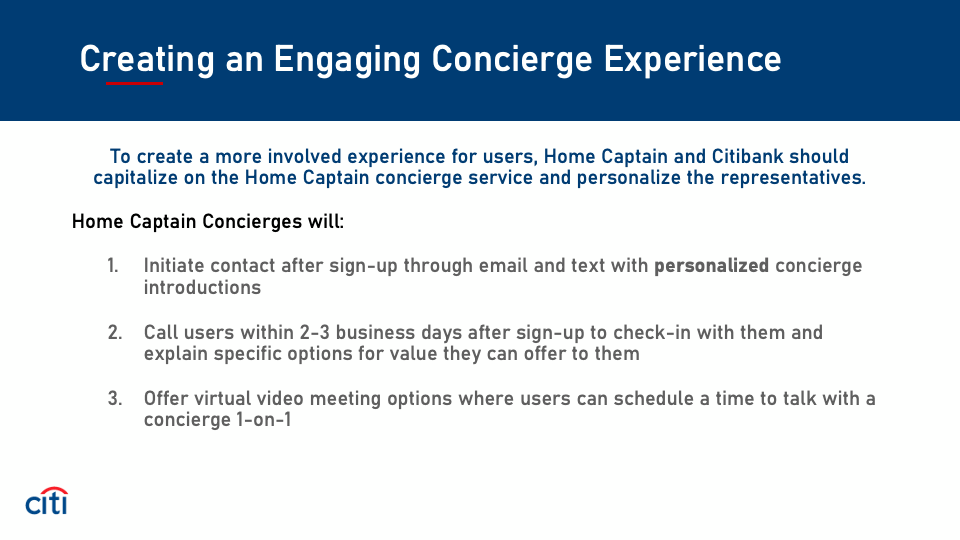

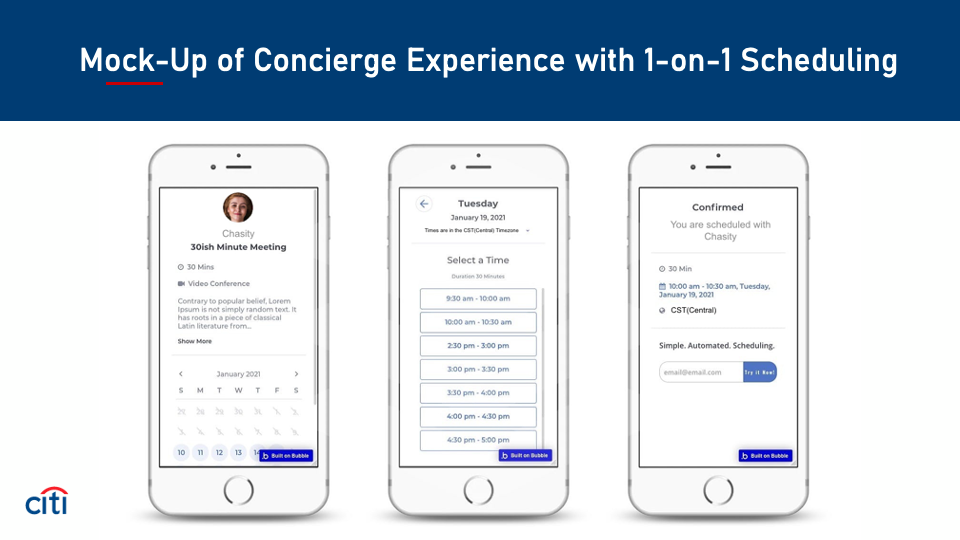

Citibank should implement a concierge service via Home Captain to:

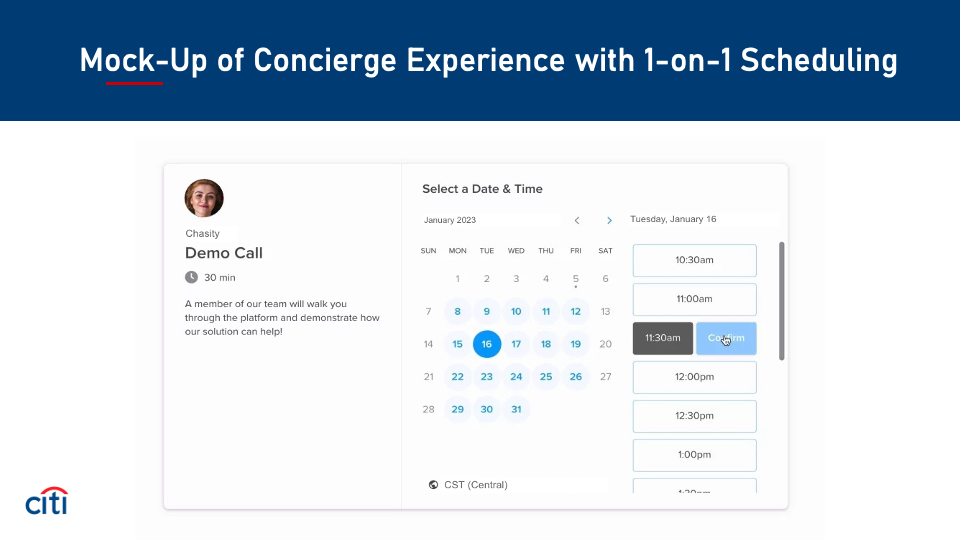

1) Initiate contact after sign-up through email and text with personalized concierge introductions

2) Call users within 2-3 business days after sign-up to check-in with them and explain specific options for value they can offer to them

3) Offer virtual video meeting options where users can schedule a time to talk with a concierge 1-on-1